Konsep 11+ Life Status Change IRS, Terbaru!

Topik menarik dari Konsep 11+ Life Status Change IRS, Terbaru! adalah

irs qualified status change, irs status change rules, life status change rules,

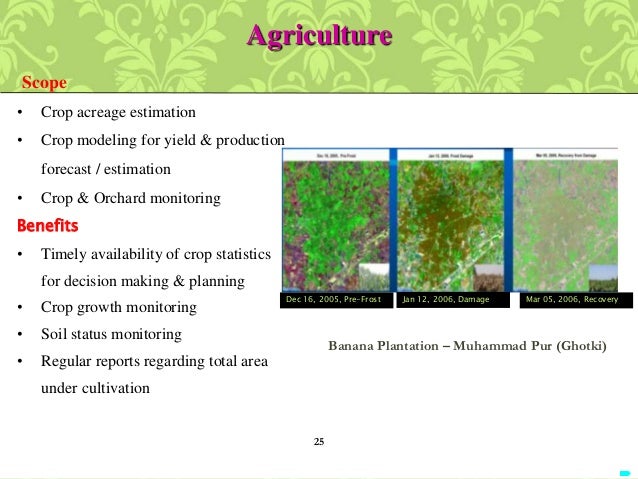

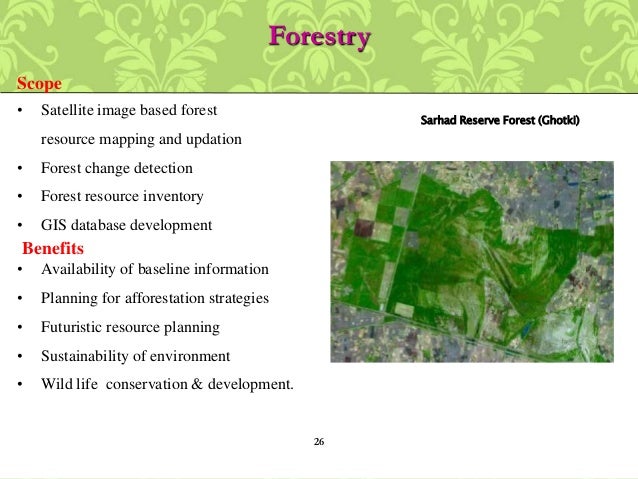

Remote sensing and GIS role in IPM Sumber : www.slideshare.net

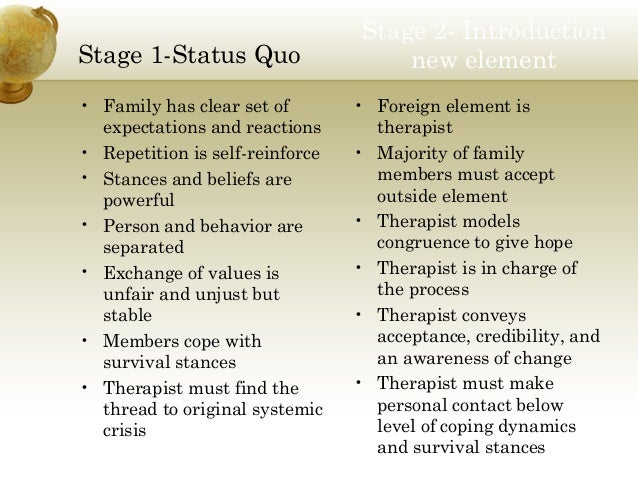

Virginia Satir Sumber : www.slideshare.net

IRS Qualified Change in Status Events NDPERS

Life Status Change IRS, IRS Qualified Change in Status Events In most circumstances an employee s annual election amounts or any insurance premiums they are having payroll deducted cannot be changed An employee may change their election if they have a qualifying life event and the election change is consistent with the event prompting the change

2019 VA Disability Compensation Rates Benefits Rate Tables Sumber : the-military-guide.com

Mila Stole My Heart How to Update Your RDO Address And Sumber : www.milastolemyheart.com

Qualifying Life Event HealthCare gov Glossary

Life Status Change IRS, Qualifying Life Event QLE A change in your situation like getting married having a baby or losing health coverage that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the yearly Open Enrollment Period

Review Your Withholding Avoid Having Too Much or Too Sumber : accountingchaos.com

What Qualifies As a Change of Life Event in Health Insurance

Life Status Change IRS, Long Awaited IRS Guidance on Changes in Family Status Provides Many Answers and a Few More Questions the IRS published long awaited change in family status guidance in the form of temporary and proposed regulations 62 FR 60165 and 62 FR 60196 These regulations clarify which events constitute a change in family status and for the first

Virginia Satir Sumber : www.slideshare.net

Long Awaited IRS Guidance on Changes in Family Status

Life Status Change IRS, IRS Sec 125 Change in Status Life Qualifying Events 04 10 2019 11 02 AM As a Retired Reservist I was ineligible for TRICARE medical coverage until I attained age 60 at which time I became covered

Roses Are Red Baseball Uses a Bat According to All Known Sumber : me.me

Understanding your W 4 Mission Money Sumber : missionmoney.org

DEPARTMENT OF THE TREASURY irs gov

Life Status Change IRS, individual s eligibility under a cafeteria plan or qualified benefits plan then that change constitutes a change in status For example if an employee switches from salaried to hourly paid status resulting in the employee ceasing to be eligible for coverage under

Roses Are Red Baseball Uses a Bat According to All Known Sumber : me.me

Petition Internal Revenue Service Revoke 501 c 3 Sumber : www.change.org

IRS Sec 125 Change in Status Life Qualifying Events LII

Life Status Change IRS, A change in status that affects eligibility under an employer s plan includes a change in status that results in an increase or decrease in the number of an employee s family members or dependents who may benefit from coverage under the plan ii Application to other qualified benefits

Change Your Benefits Cardinal at Work Sumber : cardinalatwork.stanford.edu

Did you know life events like marriage birth and irs gov

Life Status Change IRS, 12 07 2019 Organized by type of event this page provides resources that explain the tax impact of each Since life events can affect your refund or how much you owe the IRS at tax time the IRS recommends you use the IRS Withholding Calculator to check and make sure you re paying the right amount of tax from each paycheck

Roses Are Red Baseball Uses a Bat According to All Known Sumber : me.me

What Are IRS Qualifying Life Events For Health Insurance

Life Status Change IRS, This election can only be changed if you experience a life change that qualifies as an Election Change Event After experiencing an Election Change Event you have 30 days from the date of the event to contact your employer and change your election amount There are two restrictions to changes made as a result of an Election Change Event

Gyanendra Saroha M Tech CST Ph D Maharshi Sumber : www.researchgate.net

26 CFR 1 125 4 Permitted election changes CFR US

Life Status Change IRS, 14 06 2019 This counts as a qualifying life event to purchase a new policy in the new area Other Qualifying Life Events There are various other types of changes that can be a qualifying event to allow for health insurance changes This can include changes in income that can change your ability to pay the policy currently held

Roses Are Red Baseball Uses a Bat According to All Known Sumber : me.me

Remote sensing and GIS role in IPM Sumber : www.slideshare.net

FSA Election Change Events Further Learning Site

Life Status Change IRS,

0 Komentar